Introduction to

Medicare Advantage Plans, Medi Gap & View Site Map Medicare Prescription Drug Plan (PDP) aka Part D Rx

Welcome website visitor

Are you New to Medicare?

Learn about how to enroll in Part A Hospital and Part B Doctor Visits and then follow the link to Medicare’s site where you can enroll. We are happy to help you enroll and there is no extra charge when you get plans supplement Medicare, like Medi Gap, Part D Rx and Medicare Advantage.

We will try to give you everything you want to know in Plain English. Medicare might be very confusing. IMHO, if one just takes some patience and reviews the information and brochures, both from us and from Official Medicare Pamphlets, it should get clear. If not, email us, * set a meeting, * ask us a question right on our website, you don’t have to even leave your name.

We highly recommend that you at least glance through Medicare & You Publication # 10050 which gives an EXCELLENT Overview and most of the Information you will ever want to know.

If you are viewing this webpage on a full screen monitor, we show many of the Medicare Brochures to the right, if you are viewing on a smartphone, just scroll down.

Introduction to #MediGap

Our video explaining the Governments brochure on choosing a Medi Gap Policy. Click the little square on the right, to enlarge the video.

- 2023 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- Get Quotes for Medi Gap Quotit

- Medicare Supplement Policies CA Insurance Code §§10192.1 - 10192.24

- CA Health Care Advocates HI CAP Fact Sheet

- Supplementing Medicare: An Overview 10-30-20 Hi Cap

- Supplementing Medicare: Medigap Plans 12-14-23 Hi Cap

- Your Rights to Purchase a Medigap 12-14-23 HI Cap

- Search for Participating Doctors & Hospitals - Just about ALL of them!

- Anthem Blue Cross Information & Enrollment

- United Health Care

- Blue Shield – Medi-Gap Information & Enrollment

- Health Net

-

Medi Gap pays the medical expenses that Original Medicare Part A (Hospital) and Part B (Doctor) doesn't. Check out the chart on this page to see what Medicare Pays, what you pay and what a Medi Gap plan pays.

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medi-gap policy will pay its share. You’re responsible for any costs that are left. Medicare.Gov *

-

Original Medicare, Medicare Advantage nor Medi Gap pay for long term care either in a nursing home or at home care. Get more information on Long Term Care here. Even if you think you can't afford any extra premiums, there's a lot of valuable information to help with planning.

#Medicare10050 and You 2024

Everything you want to know

- Steve's Video Seminar Introduction to Medicare & You

- Audio from Medicare.Gov

- Clear View to Medicare Patient Advocate.org - 36 pages

***********

- Your Medicare #Benefits # 10116

- Audio MP 3

- Inpatient ONLY - How Medicare Pays for your Surgery Part A vs Part B Very Well Health.com

- medicare.gov/coverage

- What's Covered App for Smartphones

- Medicare Coverage Database Search

- medicare.gov/procedure-price-lookup

- MLN Items & Services Not Covered Under Medicare

- An Overview-05-19-23 CA Health Care Advocates Hi Cap

- Original Medicare: An Overview CA Health Care Advocates Hi Cap

- 2024 Premiums, Coinsurance & Deductibles – 10-19-23 CA Health Care Advocates Hi Cap

- Supplementing Medicare: An Overview 10-30-20 CA Health Care Advocates Hi Cap

- Enroll in Blue Cross

- Learn about UHC United Health Care

- Enroll in Blue Shield

- SCAN

- Use our scheduler to Set a phone, Skype or Face to Face meeting

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- TITLE XVIII—HEALTH INSURANCE FOR THE AGED - Medicare AND DISABLE

-

- Welcome to Medicare 2022 Publication # 11095

- Our webpage on Enrolling ONLINE for Medicare Part A Hospital & B Doctor Visits

- Part A Hospital rules for zero premium

- Part B – Doctors – How to sign up – Benefits

- How to apply for Part B when you lose employer coverage - during your special enrollment period # 10012

- Fact Sheet Deciding Whether to Enroll in Medicare Part A and Part B When You Turn 65 CMS.gov 15 pages

- Medicare & You: Deciding to Sign Up for Medicare Part B VIDEO

- CMS form to fill out L 564 E to prove you had Employer Coverage and get a special enrollment period, when you retire. VIDEO

- HI CAP CA Health Care Advocates Medicare Enrollment Periods

FAQ's from Medicare.Gov

#Should I get Parts A & B?

Most people should enroll in Medicare Part A (Hospital Insurance) when they're first eligible, but certain people may choose to delay Medicare Part B (Medical Insurance). In most cases, #How

It depends on the type of health coverage you may have.

- Deciding to Sign Up for Medicare Part B VIDEO

- You must pay your Part B premium every month for as long as you have Part B (even if you don’t use it).

- If I'm low income - are there any breaks?

- Interactive Q & A from IRS on when to sign up for Medicare

- I have coverage through my spouse who is currently working.

- I have retiree coverage (from my former employer or my spouse’s former employer) or COBRA coverage.

- I have TRICARE, and I'm a retired service member.

- I have TRICARE, and I'm an active-duty service member.

- I have CHAMPVA.

- I have End-Stage Renal Disease (ESRD).

- I have Marketplace Covered CA or other private insurance.

- I don't have any of these.

- medicare.gov/should-i-get-parts-a-b

- How to apply for Part B during your special enrollment period # 10012

- Fact Sheet Deciding Whether to Enroll in Medicare Part A and Part B When You Turn 65 15 pages

- FAQ's that we did

#Understanding Medicare Advantage Plans (PDF) #12026

Insurance Companies get a fee from the Federal Government, when you enroll in an MAPD plan. MAPD Plans must cover all A & B services Medicare.Gov *

That's why the premium is very low or ZERO!

- Set a phone or Skype Meeting

- We can now do SOC Scope of Appointment, before the Meeting via a 3 minute recorded meeting 2 days before. AHIP Training Module 4 Page 14 *

- #Intake Form - We can better prepare for the meeting

- Medicare Advantage (Medicare Part C): An Overview Hi Cap

- HMO - Narrow Networks?

- HI Cap CA Health Care Advocates Fact Sheet

- Do I just sign up with a Medicare Advantage Company and automatically get * Parts A & B or do I have to get those from Medicare.Gov * VIDEO

- Get Quotes, Full Information and Enroll

- MANDATED wording!: Think Advisor * ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

- FYI a 4.27.2022 HHS Office of the Inspector General report found that MAPD plans denied 13% of prior authorizations that would have been covered under original Medicare (Conversely, Medi Gap, just follows what Medicare pays.)

- 88% of MAPD enrollees are happy

-

MAPD plans often include Dental & Part D - Rx Prescriptions and often have NO premiums!

-

How is that possible?

-

The Federal Government pays them around $700/month to handle your medical care. You must continue to pay your Medicare Part B premium of about $170/month. It's best to apply when you turn 65 for the supplement plans or advantage plans, as that's the main "Open Enrollment" period, guaranteed issue for any plan.

-

-

-

Medicare Advantage Plans also have an annual open enrollment now known as AEP Annual Election Period October 7 to December 15th.

-

Additional Coverage is important as Medical Bills are increasing Seniors Credit Card Debt or leading to possible bankruptcy?

- If You Have Problems with Your Medicare Advantage Plan

- When Medicare Advantage Plans Terminate Coverage

- Medi-Cal D-SNP Feasibility Study

#MedicareRelated Pages

- Medicare – Introduction – Part A Hospital – B Outpatient – D Rx Medi Gap & MAPD

- Coverage in Part A Hospital & B Doctor Visits? Part D Rx

- Enroll ONLINE for Medicare Part A Hospital & B Doctor Visits

- Medi Gap – Supplement Plans – non conical

- Medicare Advantage Plans – Part C

- Part D Rx Prescriptions no index

You cannot buy additional coverage through #Covered California

if you have premium-free Medicare Part A Hospital

Medicare complies with Health Care Reform, so you do NOT need to get a an Individual policy or a subsidized one from Covered CA. It fact, it's illegal for anyone to sell you a policy! Kaiser Health News * Covered CA Medicare Fact Sheet * Medicare.Gov Medicare & Market Place #11694 * CMS.Gov FAQ Medicare & Marketplace * HealthCare.Gov when - how to change from Covered CA to Medicare * Social Security §1882 * Health Care.Gov

NOTE: This information also applies to people younger than 65 whose benefits begin the first month they receive disability benefits because they have Amyotrophic Lateral Sclerosis (ALS), better known as Lou Gehrig’s Disease, and to people younger than 65 who have Medicare because of a disability and are receiving SSDI Social Security Disability Insurance.

There are a lot of ands, if or buts in this complex issue. Please refer to the source material below. There are some exceptions, but they are very complex. Don't even think of getting a 1/2 correct answer over the phone. If you have to pay for Part A Hospital, then are options, like subsided Covered CA Plans. Email us [email protected] or ask a question below.

Video about Covered CA – if no Premium Free Part A – jump to 2:30 Medicare & the Marketplace (Covered CA

Medicare vs Covered CA - Publication 11694

Links & Resources

- Medicare Publication # 11694 Medicare & Covered CA

- Covered CA Medicare Fact Sheet

- InsureMeKevin.com

(3)(A)

(i) It is unlawful for a person to sell or issue to an individual entitled [no premium] to benefits under part A or enrolled under part B of this title (including an individual electing a Medicare+Choice plan [MAPD] under section 1851)—

(I) a health insurance policy with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled under this title or title XIX,

(II) in the case of an individual not electing a Medicare+Choice plan, [aka MAPD Medicare Advantage] a medicare supplemental policy with knowledge that the individual is entitled to benefits under another medicare supplemental policy or in the case of an individual electing a Medicare+Choice plan, a medicare supplemental policy with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled under the Medicare+Choice plan or under another medicare supplemental policy, or

(III) a health insurance policy (other than a medicare supplemental policy) with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled, other than benefits to which the individual is entitled under a requirement of State or Federal law.

(ii) Whoever violates clause (i) shall be fined under title 18, United States Code, or imprisoned not more than 5 years, or both, and, in addition to or in lieu of such a criminal penalty, is subject to a civil money penalty of not to exceed $25,000 (or $15,000 in the case of a person other than the issuer of the policy) for each such prohibited act. Sec. 1882. [42 U.S.C. 1395ss]

Our webpages that touch on this Issue:

Prescription Drug 2022 #RxGuide

PDF # 11109

*****************

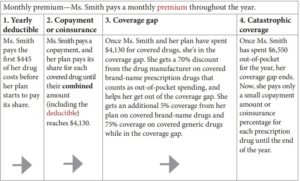

Coverage Gap - Donut Hole $2,000 Cap

******************

- Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Our webpage on High Income Surcharge IRMAA

- Ways to pay your premium - See page 17

- Kaiser Foundation Introduction - Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- D-001-Medicare Part D: An Overview – 10-31-23

- D-002-Prescription Drug Resources – 11-07-22

- D-003-When Your Part D Prescription is Denied– 11-22-22

- Medicare Rx Benefit Manual Rev 1.2016 83 pages

- Network Pharmacies, Formularies & Common Coverage Rules # 11136

- Insulin Maximum Co Pay $35

- Graphic on Part D Premium Increases & Why?

- Maximus Appeals LEP Late Enrollment Penalty

- VIDEO How Part D Late Enrollment Penalty is calculated

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

History of Medicare

on cms.gov

cms.gov/History cms.gov/KeyMilestones.pdf

Retiree’s Facing Higher Health Care Costs

Consumer Resources & Links

- Medicare.Gov Eligibility Tool

- Privacy… having a friend talk to your MD # 11441

- CBS News 10.2015 How will you get Health Insurance in Retirement?

- Calif. Department on Aging

- 2015 Costs to remain the same CA HealthLine

- Law Help.org Medicare

- medicare.gov/cost/ deductibles, co pays, premium

- Reforms to the Medicare payment system are meant to promote greater efficiency in the healthcare delivery system by restructuring Medicare reimbursements from fee-for-service to bundled payments.[44][45] Under the new payment system, a single payment is paid to a hospital and a physician group for a defined episode of care (such as a hip replacement) rather than individual payments to individual service providers. In addition, it has been asserted that the Medicare Part D coverage gap (commonly called the “donut hole“) will shrink incrementally, closing completely by January 1, 2020.[46] Wikipedia

- The CBO averred that the bill would “substantially reduce the growth of Medicare’s payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs”[216]—ultimately extending the solvency of the Medicare trust fund by 8 years.[249]

- Q & A on Medicare’s Website ♦

- Health Affairs.org ♦

- AHIP info ♦

- See our Medicare Advantage Page

Set a personal Consultation Time

https://medicarerockstars.com/

https://www.cms.gov/Medicare/Medicare-Advantage/Plan-Payment/MedicalLossRatio

https://insuremekevin.com/creating-a-spreadsheet-to-compare-medicare-advantage-plans/

Wed, 24 Dec 2008

Steve,

I was looking for some specific Medicare information and found your site on Google.

You have a great site. It is very informative without a lot of meaningless information.

I thought I’d tell you that. I think I am glad you are not in my area. I’d hate to have you as a competitor.

Best regards,

Mark A. Squires.

Principal

Squires. and Associates

Independence MO

Do I need to sign up to continue my coverage each year?

Generally no, it’s automatic renewal.

I presume you are talking about a Medicare Advantage plan. Yes, there are warnings all over the “typical” Summary of Benefits that Medicare must renew the contract with the insurance company for your plan to renew.

Did you get an ANOC – Annual Notice of Change or cancellation notice?

What should I do if I get this notice?

Review any changes to decide whether the plan will continue to meet your needs in the next year.

If you don’t get this important document, contact your plan.

If you send us privately [email protected] your current ID card or other documentation to verify your current coverage, we can see what your renewal terms are.

Many thanks. Very good information!

I’m not a happy camper with Kaiser MAPD….

Yeah, but the care is poor and designed for cost savings at the patient’s expense. Here are our real life examples:

Kaiser: loaner CPAP machine and get a personal CPAP

Outside: overnight sleep study at a clinic covered in-network to properly diagnose the true extent of sleep apnea. Get CPAP.

Kaiser: thyroid is on the low side of normal, but it doesn’t feel right. Kaiser PCP thinks all is OK.

Outside: Armour thyroid treatment (Kaiser won’t prescribe this) in-network

Kaiser: 2 months or more to get a psychiatry appointment and therapist. Only once every 2-3 months for both.

Outside: Use a PPO to find an out-of-network psychiatrist that can take an appointment this week Same for therapist.

ER doc: Shaking in the hands. Why aren’t you seeing a neurologist? You need to start seeing a doctor rather than come to the ER.

Patient: But I have a Kaiser neurologist that I have for years and I saw last week and he has been unsuccessful at treatment.

Kaiser: Thinks granny is a drug seeker. Granny has “medieval Game of Thrones torture” 12 out of 10 pain. Unable to get PCP to take her seriously.

Actual: Unrelated surgeon found a huge sack of pus in the hip that has destroyed her hip joint and it was the source of her pain.

Granny is on 25 concurrent prescription medications. I found that a good time saving way to push patients out the door is to prescribe meds. Granny doesn’t have the mental ability to question the wisdom of being on 25 meds concurrently or risk getting an opiate addiction.

If you have easy to diagnose diseases, Kaiser works OK and it’s very convenient. It actually works fine for myself if I didn’t know any better.

For members of my family who have difficult to treat diseases, it’s pretty piss poor. You don’t want to be sick and on Kaiser. It’s like choosing convenient McDonalds vs. a dinner service only steakhouse. McDonald’s rushes to serve you food within 2 minutes and it is edible. It’s also open 24 hours. It’s also very low cost. Steak place might be unaffordable especially if government is paying for a huge part of the bill.There you go, McD should get five stars even though it’s processed food crap because the crap is edible. In Norcal, Senior Advantage is very expensive with high copays and premiums. Why not just prepay with premiums on plan A/B/D/F, get no copays other than rx, and then choose the doctor of your choice that you can easily fire. You can’t fire a specialist at Kaiser without a ton of social engineering.